To date, more than 8.5 million people have been automatically enrolled in a workplace pension by nearly 800,000 employers.

The Pensions Regulator recently published their annual commentary and analysis report, which shows that more than 70% of all new businesses will have staff they will need to put into a workplace pension. This means the majority of new employers will have full automatic enrolment duties and will need to set up a pension for their staff.

Since the beginning of October 2017, anyone thinking of taking on staff for the first time should start planning for their automatic enrolment responsibilities. As soon as they take on staff they will have workplace pensions duties.

Planning for automatic enrolment should be carried out alongside all the other tasks associated with running a business – for example, setting up PAYE.

If an employer has eligible staff to put into a pension scheme, they will need to identify a provider and they should leave plenty of time to do this. They should also ensure their chosen payroll solution is compatible with their scheme so that staff receive the pensions they are entitled to on-time.

Within five months of taking on staff, employers must complete a declaration of compliance to tell The Pensions Regulator what they have done to meet their duties.

Employers and their advisers should be aware that meeting their duties late or failing to set up a scheme as soon as they employ eligible staff, will not save them money. This is because contributions will need to be backdated to the date they first employed staff.

On-going duties

Automatic enrolment is not a one off-task – employers also have on-going duties. This means they must continue to assess staff and keep records.

Every three years, employers must automatically enrol staff who initially opted out back into a workplace pension. They must then complete a re-declaration of compliance within five months of the anniversary of their staging date. Between now and the end of the year, 12,000 employers are due to complete their re-declaration of compliance.

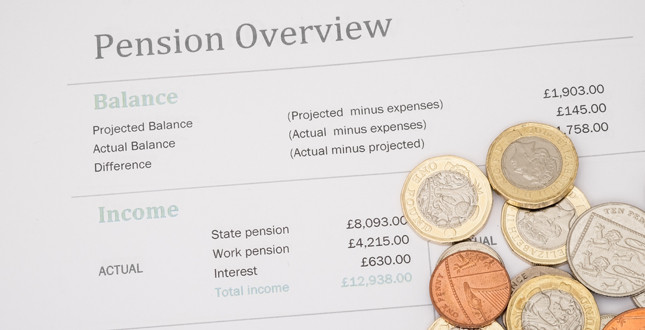

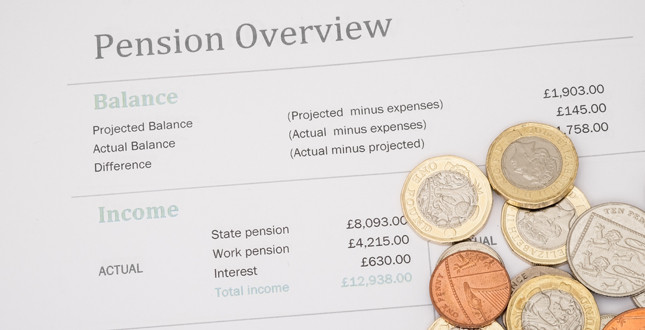

Increases in contributions

The below figures are calculated on earnings between £5,824 to £43,000 per year (£486 to £3,583 per month, or £112 to £827 per week), and including certain elements of pay.

Until 5 April 2018, employer minimum contributions stand at 1% with a 1% staff contribution. On 6 April 2018, all employers are required to increase their contributions into their staff's automatic enrolment pension to at least of 2%. Staff contributions will also increase so that their contributions make up the shortfall needed to bring the total minimum contribution up to 5%.

Contribution levels will rise again on 6 April 2019, with employers paying a minimum of 3% towards the pension, and the total minimum contribution reaching 8% - with staff making up the 5% difference.

Compliance and enforcement

While compliance with the law remains high, there are a small minority of employers who fail to meet their duties. The Pensions Regulator will take action to ensure staff receive the pensions they are entitled to.

For information and guidance on what employers need to do to meet their duties, and by when, visit www.tpr.gov.uk/employers.

If you'd like to keep up-to-date with the latest developments in the heating and plumbing industry, why not subscribe to our weekly newsletters? Just click the button below and you can ensure all the latest industry news and new product information lands in your inbox every week.